Irmaa Calculation For 2024

Irmaa Calculation For 2024. Filing individually income > $103,000. Once you have determined your inputs, you.

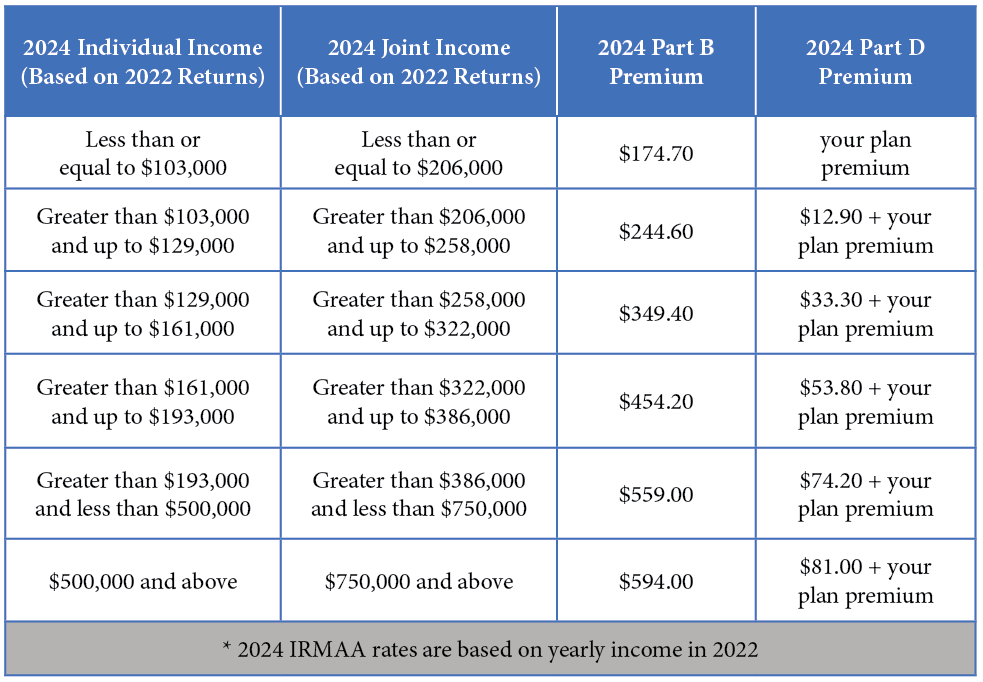

Irmaa is determined by income from your income tax returns two years prior. Your medicare irmaa amount in 2024 is determined by your reported income in 2022.

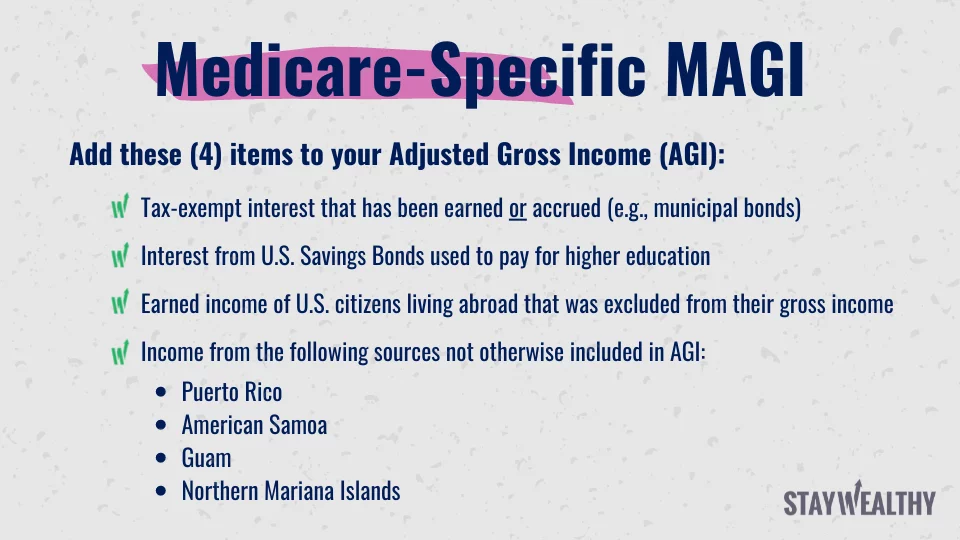

The Annual Medicare Irmaa Is Determined Using A Person’s Modified Adjusted Gross Income (Magi) From Two Years Prior.

Once you have determined your inputs, you.

The Social Security Administration (Ssa) Uses This Information To.

Irmaa applies in 2024 if your modified adjusted gross income from 2022 is above these thresholds:

Irmaa Calculation For 2024 Images References :

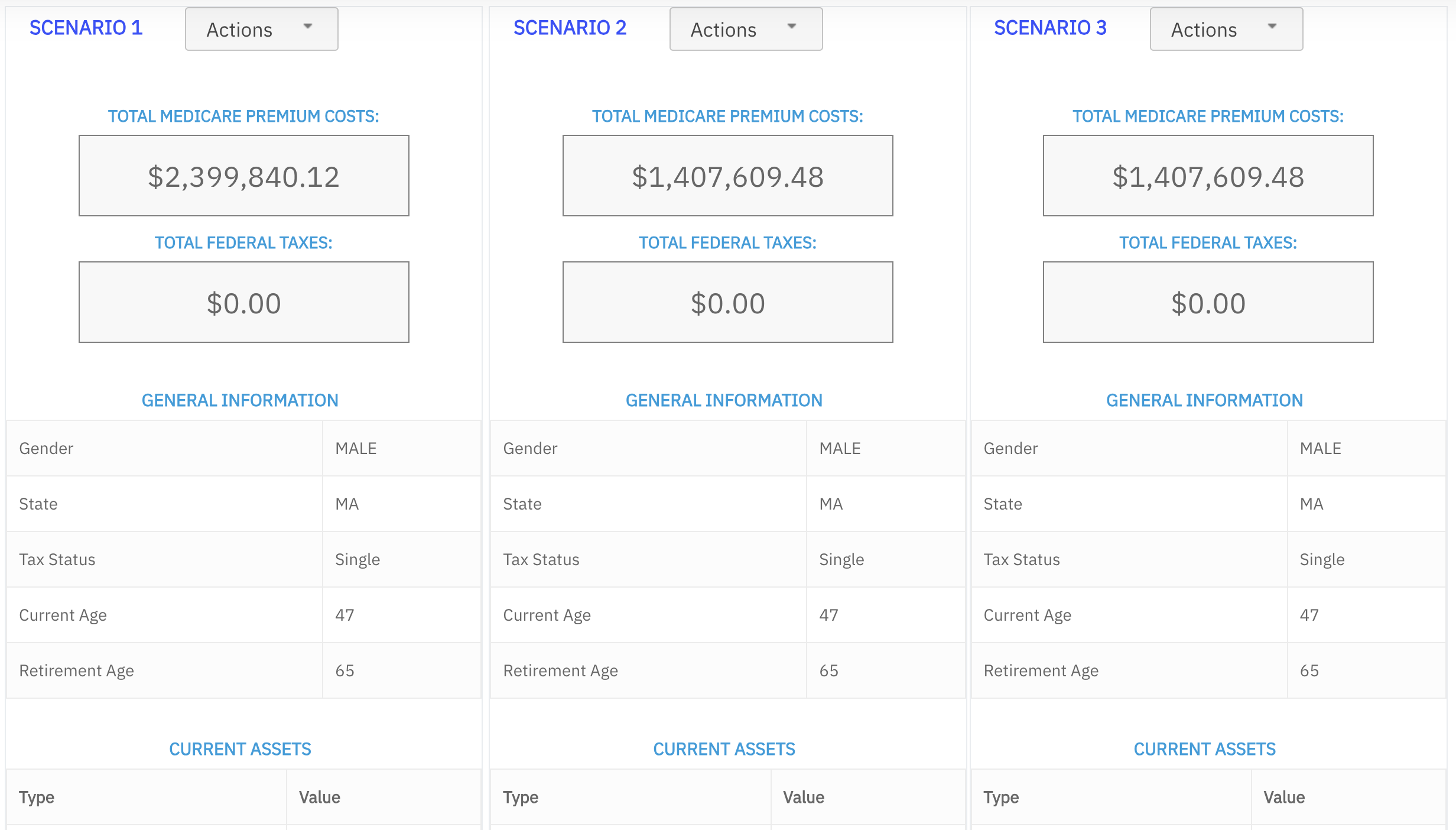

Source: www.healthcareretirementplanner.com

Source: www.healthcareretirementplanner.com

Medicare IRMAA 2024 What to Expect for Surcharges in the Coming Year, What are the 2024 irmaa brackets? There are also three tax filing status levels.

Source: investguiding.com

Source: investguiding.com

What IRMAA bracket estimate are you using for 2024? (2023), How is irmaa calculated for 2025. The 2024 irmaa brackets by law are going to be larger than 2023.

Source: youstaywealthy.com

Source: youstaywealthy.com

Medicare IRMAA Brackets 2024 Everything You Need to Know, Whether it’s adjustments to income thresholds or modifications in the calculation method, beneficiaries need to be aware of the changes that may impact. Irmaa, which stands for income related monthly adjustment amount, can be confusing, even to those.

Source: nelldarline.pages.dev

Source: nelldarline.pages.dev

2024 For 2024 Irmaa Brackets Kylie Kaylee, Filing individually income > $103,000. Irmaa represents the additional amount that some people might have to.

Source: www.socialsecurityintelligence.com

Source: www.socialsecurityintelligence.com

The 2024 IRMAA Brackets Social Security Intelligence, The social security administration (ssa) uses this information to. The standard monthly premium for medicare part b enrollees will be $174.70 for 2024, an increase of $9.80 from $164.90 in 2023.

Source: www.youtube.com

Source: www.youtube.com

2024 Medicare IRMAA Explained YouTube, Understanding the 2024 irmaa brackets: Irmaa is determined by income from your income tax returns two years prior.

Source: meldfinancial.com

Source: meldfinancial.com

Medicare Premiums and Coinsurance Raised for 2024 Meld Financial, 2024 income planning & 2026. Magi is calculated based on the.

Source: gmiainc.com

Source: gmiainc.com

GMIA, Inc. 2024 Part B Costs and IRMAA Brackets, The charts below show the five different irmaa levels for each of. The social security administration (ssa) determines who pays an irmaa.

Source: socialsecuritygenius.com

Source: socialsecuritygenius.com

The IRMAA Brackets for 2024 Social Security Genius, The charts below show the five different irmaa levels for each of. The annual deductible for all.

Source: www.youtube.com

Source: www.youtube.com

Medicare IRMAA Calculator Tutorial YouTube, Irmaa applies in 2024 if your modified adjusted gross income from 2022 is above these thresholds: This means that for your 2024 medicare premiums, your 2022 income tax return was used.

Whether It’s Adjustments To Income Thresholds Or Modifications In The Calculation Method, Beneficiaries Need To Be Aware Of The Changes That May Impact.

Use this calculator to determine your medicare irmaa charge for making over the income limit for medicare.

Irmaa Applies In 2024 If Your Modified Adjusted Gross Income From 2022 Is Above These Thresholds:

The income limit for irmaa in 2024 is $103,000 for individuals and $206,000 for couples.

Category: 2024